M&A Consulting

- How much money is wasted when M&As don’t work because the people part of the equation wasn’t addressed?

- We offer diagnostics for the planned merging of teams.

- We will predict hidden pitfalls, personal clashes, and identify potential wins.

- We will help you facilitate the process.

In a recent news headline Deloitte said, “Research shows that 70% of international merger projects fail due to cultural factors. Moreover, 70% of M&A deals fail to create value. Why?

Too often, a focus on financial quick wins and product portfolio alone takes priority over shared objectives and transparency.” M&A’s today fail due to personality clashes and cultural issues. There’s a failure to focus on the people part of the equation.

A close friend working for a major investment bank told me, “We had a major initiative to improve the efficiency of the department. We had 250 employees. They spent £125,000 on the initiative. Unfortunately, it was all spent on processes and procedures, and it failed spectacularly. If they had only spent 15% of that on the people side of the equation it would have worked”. He went on to say, “Sadly I see this all the time. When will people at the top get that they need to turn things upside-down and work with the people first?”

Introduction:

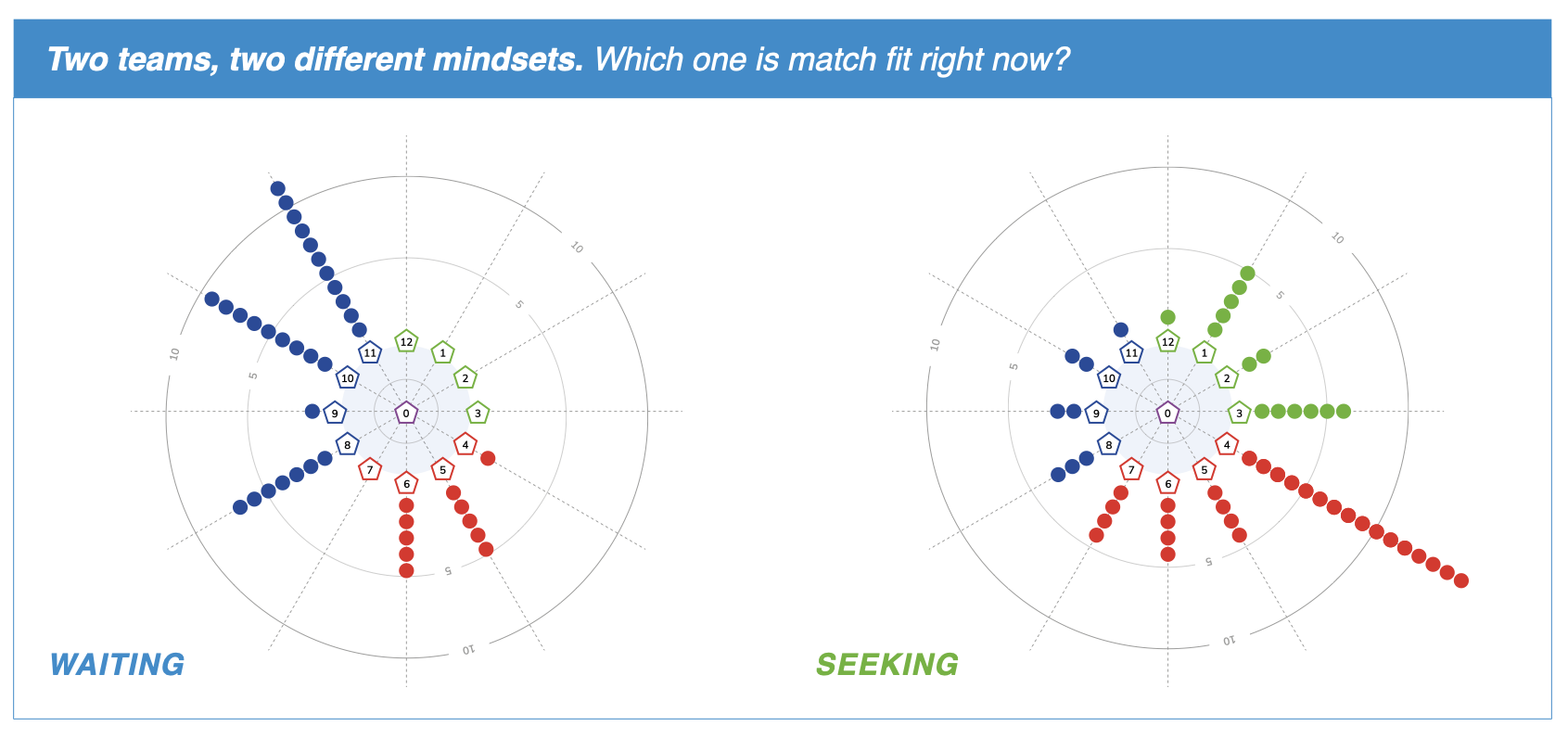

When we first developed the ‘Team Maps’ and showed them to clients the immediate comments (besides them being seen as ‘Game-Changers’) was,

“You must use these in M&A. It would be invaluable for the incumbent and incoming teams to predict the potential flashpoints and to see the upside of the combined team”.

Best managed companies

Pride themselves on their leadership, commitment to people and culture. A lack of trust in a time of uncertainty during a M&A transaction can undermine everything. Consider how employees may behave:

- The court intrigues

- The whiff of fear

- The politics

- The hidden agendas

- The backstabbing

- The protectionism

- The us vs them scenario

- The hoarding of information

- Job insecurity

- The passive aggression turning to massive aggression

Solution:

Trust increases when the leadership on both sides of an M&A transaction focus on cultural sensitivity, job security, integration, morale, quality communication. This requires effective facilitation to make everything visible, transparent, and tangible. Effectively, put all the cards on the table. Find a way to have a rational, constructive, cool, calm, collected, and civilized conversation. Your facilitator will be your lightening rod. All the angst, anger, and frustration will simply pass through them. They are there to help not hinder!

FAQs

What do we do?

1. Management and organisational due diligence. We help investors understand the ability of a team and organisation to deliver a growth plan and ways to improve the chances of success.

2. Top team development. We work with boards and teams to build confidence and improve the effectiveness in the ways the team leads the business.

Who?

We help Investors, Boards and Senior decision-makers. We will provide you with deeper insights on the strengths, risks, potential and development needs of individual executives and leadership teams.

We help client organisations. We will work with you to transform the ways things are done to unlock potential and deliver higher performance. We can help you deliver new strategies underpinned with expert subject matter, facilitation, and partnership.

We help leadership teams. We will help you to develop your people to maximise performance. Our wide-ranging intellectual property spans the full spectrum of leadership skills, knowledge and mind sets required for success.

Why?

We help small and mid-size growth companies evolve, scale, and create value. Growing a company can be fun but very frustrating. It’s often lonely attempting to do it on your own. A company in a growth stage will typically have well-qualified people They will have a track record in their market and great ideas and ambition. However, the teams which provide the momentum are rarely complete and the wider organisation is often scrambling to catch up. We can help you add value in your recruitment, succession planning and emerging leadership teams with our solutions.

Getting from today to a bigger, better, brighter tomorrow can involve solving hundreds of often complex – issues. But there are, in reality, only seven contextual ways to grow and lead a business. The rest is pure operational management.

How?

We work in partnership. The issues we work on with investors and managers cannot be completely outsourced: we must work with you to coordinate what is essentially a co-creation process. When we work together, we are on your team, not just paid consultants.

Better quality decisions always happen when everyone feels fairly treated and the process is constructive. This is especially true when a team is going through a merger or an acquisition.

Conclusion:

Who benefits most from working with Perfect Teams?

Our direct style seems to work with some investors, directors, and leadership teams more than others. It is geared towards:

Investors who can see that current methods for dealing with existing management, organisation and strategy issues are still imperfect and require improvement.

Chairs and leadership teams who want to build more success by overcoming the inevitable obstacles to growth. Getting clarity on the seven ways to grow creates the momentum required.

With Neil’s help I doubled the turnover, tripled the profit, and only added 30% staff – Grant J. – Built and sold his company to Call Credit for £5million.

“I was looking for a vision, commercial insights, and the ability to control my attitude in a challenging period of time. The tools I got from Neil helped me, and my team, to successfully present our proposition and negotiate our exit by selling out to an international agency”. – John G – Sold for £8million